Automation revolution: robotics VC funding in Europe

January 2026 | FEATURE | PRIVATE EQUITY

Financier Worldwide Magazine

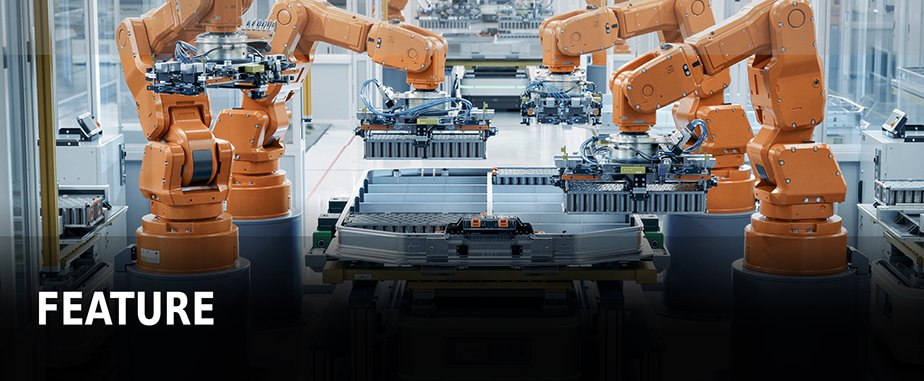

Venture capital (VC) funding into robotics has surged in recent years, drawing considerable interest across a range of sectors. While humanoid robotics start-ups naturally attract the most attention, they are not currently the primary focus for many investors. Consumer-facing humanoid robots, for the time being, remain largely confined to cutting-edge prototypes, if not science fiction. Instead, the areas attracting the greatest levels of funding – both generally and from VCs specifically – are more diverse, including surgical robotics, operating systems and manufacturing automation.

The global robotics industry is geographically varied, with significant activity in the US, Europe and China. According to ABI Research, the global robotics market is valued at nearly $50bn in 2025, representing an 11 percent increase compared to 2024. With a compound annual growth rate of 14 percent, the market is projected to reach $111bn by 2030. By that time, nearly 13 million robots are expected to be in circulation.

Companies are increasingly turning to robotics to address labour shortages and improve efficiency, quality and time-to-value. From original equipment manufacturers to computing platforms, artificial intelligence (AI) software vendors and technology implementers, robotics offers substantial commercial potential. Robotics software alone is forecast to generate $24.5bn in revenue by 2030, as it is deployed for analytics and a wide range of other applications.

2025 has been particularly notable for robotics funding. According to Crunchbase, investors committed $6bn to robotics start-ups in the first seven months of the year. At this pace, the sector was on track to surpass 2024’s funding levels. Significant capital has been made available for the critical early stages of research, development and hardware innovation.

Funding momentum and regional shifts

The Asia-Pacific region drives the highest volume of robotic shipments and revenue due to its industrial maturity. China leads in robotics and VC investment, and alone accounts for 42 percent of global revenue from industrial robots.

Nevertheless, Europe has also experienced a resurgence in robotics VC funding in recent years. Robotics-focused VC firms are emerging in key investment hubs such as London and Berlin, often concentrating on industrial automation and deep tech. These firms benefit from Europe’s strong manufacturing base and research capabilities.

Much of the investment in Europe is underpinned by the region’s reputation for high standards in safety, quality and integration, particularly in automotive, medical and service robotics. Another area attracting investor attention is warehouse automation. Technologies such as robotic picking systems, advanced inventory management and autonomous mobile robots that transport goods across warehouse floors are helping to accelerate delivery times and reduce operational costs. This emphasis on specialisation has enabled Europe to attract significant robotics VC investment, even though China and the US continue to draw greater overall volumes of funding.

According to PitchBook data released in September, just over €1bn has been invested across 84 deals. If this momentum continued through the second half of the year, 2025 could surpass the previous peak of €1.4bn recorded in 2021. AI has received considerable attention – and criticism – in recent months, but its role in driving investment cannot be overlooked. AI has enabled more scalable and commercially viable applications for robotics, contributing to a marked increase in investment. There has also been a growing push for automation in service industries, hospitals and warehouses, aimed at managing labour-intensive and repetitive tasks. This trend is largely driven by the need to reduce costs amid rising wages and persistent labour shortages.

“To maintain its position as a leading destination for robotics and automation VC funding, some analysts have called for the development of a strategic plan and a clear operational vision to scale up the sector.”

Robotics start-ups have secured several major investment rounds. Among the most notable are Germany-based Neura Robotics, which closed a €120m series B round in January, and Cambridge’s CMR Surgical, which raised $132m in April to expand its AI-powered surgical robotics platform. Much of this investment has come from German and US investors, spanning areas such as humanoid robots, AI integration, generalist robot software and the emerging ‘robotics as a service’ model.

2025 has also been a record year for European robotics VC by value, according to PitchBook. This has been driven by a small number of very large rounds – typically in the multi-€10-100m range. VC activity has been supported by public and grant funding, particularly from the European Union (EU). Programmes such as Horizon Europe and the European Commission’s robotics initiatives have continued to subsidise research and development and help de-risk certain technologies. These programmes are not a substitute for VC investment, but rather complement it.

In the coming years, robotics could become a central pillar of Europe’s strategy to boost productivity, address demographic challenges and safeguard industrial sovereignty in the face of growing competition from China, the US and other countries.

Strategic vision for Europe’s robotics future

To maintain its position as a leading destination for robotics and automation VC funding, some analysts have called for the development of a strategic plan and a clear operational vision to scale up the sector. Prioritising areas such as transportation and logistics, hospitality, agrifood, construction, healthcare, aerospace and defence may prove beneficial. Similarly, establishing a legal and business framework to expand the critical mass of the VC market and harmonising regulation – particularly across the EU – could help strengthen Europe’s robotics ecosystem.

Looking ahead, companies and markets that adopt robotics and automation – including those in manufacturing, warehousing and construction – are likely to remain attractive to robotics investors in Europe and beyond.

© Financier Worldwide

BY

Richard Summerfield